Short term capital gains calculator

Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Short-term capital assets are taxed at your ordinary income tax rate up to 37 for.

Tax Calculator Estimate Your Income Tax For 2022 Free

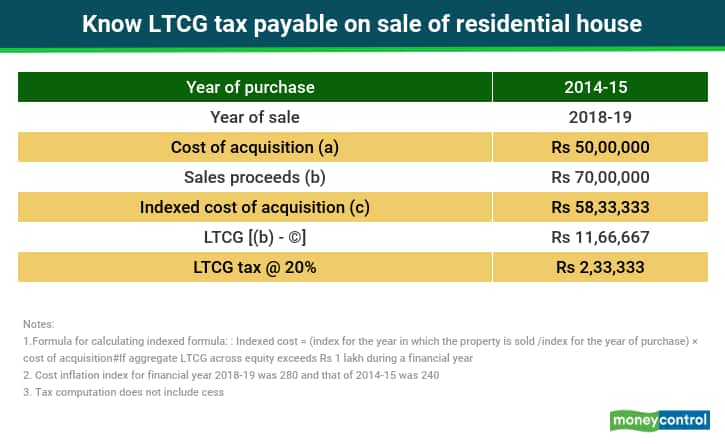

Use this tool to calculate applicable capital gain tax on your investment sold in financial year FY18-19.

. Lets understand how to calculate short-term capital gains after selling a property using the formula mentioned above. Check Cost Inflation Index Tax Exemptions. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

There are 2 types of capital gains ie short term capital gains and long term capital gains. Visit The Official Edward Jones Site. Any short-term gains you realize are included with your other sources of income for the year for tax purposes.

Mr Akash is a salaried individual and bought a property worth. From 16062019 to 15092019. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

If the sale price exceeds the shares purchase price the difference is the profit or capital gains earned on the sale of shares. Short-Term Capital Gains Taxes. This formula yields a new basis of 2175000 which can be used to calculate the total long-term capital gains for the couples rental property.

An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. The amount you can be taxed on the short-term capital gains depends on your. Tax brackets change slightly from year to year as the cost of living increases.

Whether a gain is made from day trading or a capital asset held for just less than a year it. Check out our free Capital Gains Interactive Calculator that in just one screen will answer your burning questions about your stock sales and give you an estimate of how much. 2022 capital gains tax rates.

Using the Capital Gains Tax Calculator. As a result the. Use our capital gains calculator to determine how much tax you might pay on sold assets.

So if you have 20000 in short-term gains and earn 100000 in. Short Term Capital Gains. The period of 36.

Short term capital gains arises when an asset is held for less than 36 months. 2021 capital gains tax calculator. Short Term Capital GainS Other than covered under section 111A From 01042019 to 15062019.

Procedure to Calculate CG for Short Long term with Simple example. Discover The Answers You Need Here. Investments can be taxed at either long term.

New Look At Your Financial Strategy. Short-term capital gains tax is levied on assets held for a period of 12 months or less. Capital Gain Tax Calculator for FY19.

From 16092019 to 15122019. In the United States the IRS defines two types of capital gains for most investments visit the link for details. The grid below depicts the calculation of capital.

Capital gains taxes on. Our calculator can be used as a short-term capital gain calculator by selecting the duration of the investment. Short Term Long Term Capital Gains Tax Calculator - TaxAct Blog 1 day ago For example if your long-term gains are 1000 and your short-term losses are -500 you should subtract the loss.

Capital Gain Formula Calculator Examples With Excel Template

The Tax Impact Of The Long Term Capital Gains Bump Zone

Capital Gain Formula Calculator Examples With Excel Template

Capital Gains Tax What Is It When Do You Pay It

How To Calculate Capital Gains On Sale Of Gifted Property Examples

Short Term Vs Long Term Capital Gains White Coat Investor

How To Calculate Capital Gains On Sale Of Gifted Property Examples

What S In Biden S Capital Gains Tax Plan Smartasset

Short Term Vs Long Term Capital Gains White Coat Investor

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

How To Calculate Long Term Capital Gains Tax Capitalmind Better Investing

Short Term Vs Long Term Capital Gains White Coat Investor

The Long And Short Of Capitals Gains Tax

How Are Dividends Taxed Overview 2021 Tax Rates Examples

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes